A moving average is a statistical analysis method that creates a series of averages from data points. It is a finite impulse response filter and can be computed in simple, cumulative, and weighted forms. Here’s an overview of this mathematical algorithm. Hopefully, this article has shed some light on this important statistic. If you’re interested in learning more about moving averages, read on. You’ll be surprised at the many applications for these statistics.

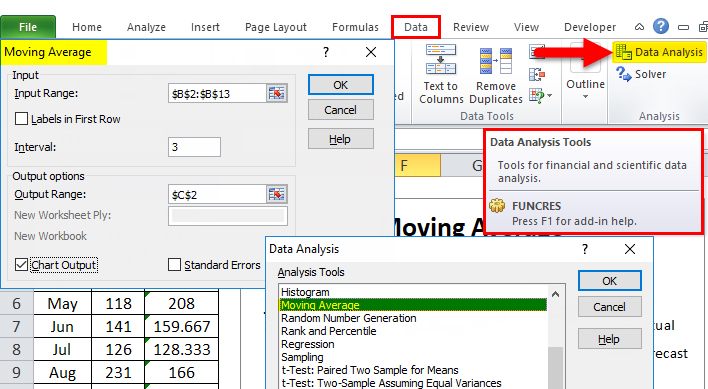

In Excel, you can calculate a three-year moving average by entering data for the years 2003 to 2005. Then, you can enter values in the Input Range and Output Range fields, and choose a preferred Interval and number of values for each subset. Click OK to finish. You may see #N/A errors if there are too few values for some subsets. Then, you can plot the results in the graph.

Another form of the moving average is the exponential moving average. This is calculated by summing the prices of an instrument over a period of time. It is also called a rolling average. There are many variations of this simple moving average, including simple, cumulative, and weighted. For example, if you want to calculate the daily closing price of the Dow Jones Industrial Average, you would divide the data by two. In addition, you would then multiply the value by two to get the exponential moving average.

When used correctly, moving averages can help you spot trends in the market. They smooth out the noise on the price chart and can help you determine the direction of a trend. The length of the moving average is based on closing prices, but it can be calculated using other indicators as well. The shorter the moving average is, the more false alarms it can give you. However, the longer the length of the moving average, the more reliable it can be, as long as it tracks the large trends in the market.

Another version of the moving average uses the exponential weighting method. This method assigns more weight to recent prices while discarding the older ones. By using exponential weighting, it is possible to reduce the lag of the moving average by up to one day. This means that you can use this method to detect a trend and make decisions accordingly. There are many other variations of moving averages, so take some time to learn the best one for your particular needs.

Moving averages work well in combination with other fundamental and technical data points and can help you formulate a general outlook on individual stocks or the entire stock market. It’s important to remember that past performance is not indicative of future results. While stocks can swing widely from day to day, the technical indicators can help you determine where the trend is headed. This type of data is not a substitute for independent research. So, when you’re deciding which stocks to buy or sell, consider the moving averages performance and whether it’s a good idea for you.

Moving averages are important tools for technical analysts and investors. They can help you spot buy and sell signals and identify support and resistance zones. The simple moving average is calculated by taking the closing price of a stock for five days. The exponential moving average is more responsive to recent data points and applies the same weight to all price changes during a period. When using moving averages, always remember to monitor your trading results to avoid losses. They will help you make informed decisions, so keep reading!