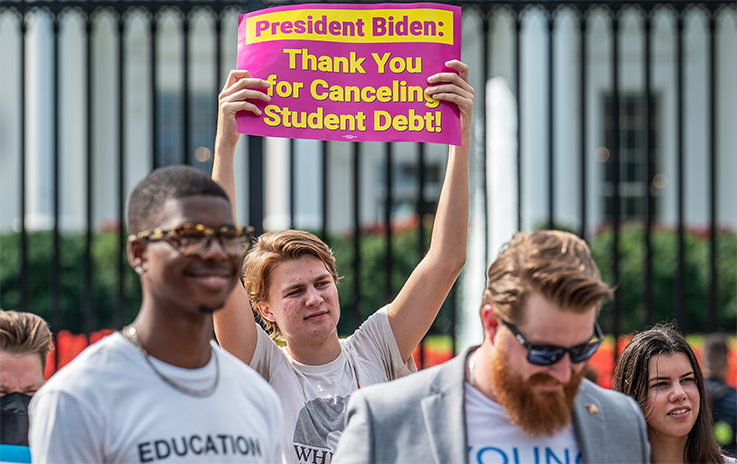

In a move that has garnered significant attention and stirred both praise and debate, President Joe Biden recently announced a bold plan to cancel $400 billion in student loan debt. This decision comes as a response to the ever-increasing burden of student loan debt on millions of Americans and aims to provide much-needed relief to borrowers. As the details of this plan unfold, it’s crucial to delve into the potential impact and implications that such a substantial student loan cancellation could have on individuals, the economy, and the education system.

Understanding the Scope of the Plan

President Biden’s proposal entails the cancellation of $400 billion worth of student loan debt. This debt relief would primarily target federal student loans, focusing on borrowers who have been struggling with their loans for an extended period. The plan aims to provide relief to borrowers from a wide range of backgrounds and income levels, with a focus on addressing the racial and economic disparities that have been exacerbated by the student loan crisis.

Immediate Relief for Borrowers

The potential impact of this student loan cancellation is substantial, particularly for borrowers who have been grappling with the weight of student debt for years. The immediate relief provided by the cancellation could alleviate financial stress and improve the overall well-being of countless individuals. With the burden of student loans lifted, borrowers could redirect funds toward other essential expenses, such as housing, healthcare, and saving for the future.

Boosting Economic Stimulus

Beyond individual relief, the broader economic implications of the $400 billion student loan cancellation are noteworthy. The newfound financial flexibility of borrowers could stimulate consumer spending, driving economic growth. As individuals have more disposable income at their disposal, they are likely to contribute to various sectors of the economy, such as retail, tourism, and leisure. This economic boost could play a crucial role in the nation’s post-pandemic recovery.

Potential for Increased College Access

The student loan crisis has often discouraged potential students from pursuing higher education due to the fear of accumulating insurmountable debt. By implementing a significant student loan cancellation, the government could signal its commitment to making higher education more accessible and affordable. This move could encourage individuals who previously hesitated to enroll in college or pursue advanced degrees to reconsider their options, leading to a more educated and skilled workforce.

Debate Over Fairness and Accountability

While the proposal has been welcomed by many as a much-needed step toward alleviating student loan debt, it has also sparked debates over fairness and accountability. Critics argue that widespread debt cancellation might be perceived as unfair to those who have already paid off their loans or made significant progress toward repayment. Balancing the needs of both borrowers and those who have already fulfilled their financial obligations will be a challenge for policymakers.

Long-Term Fiscal Impact

Another critical consideration is the long-term fiscal impact of the $400 billion student loan cancellation. Critics express concerns over the potential strain on the federal budget and the government’s ability to fund other essential programs. Addressing these concerns requires careful planning and a comprehensive understanding of how the cancellation might affect the broader financial landscape.

President Biden’s proposal to cancel $400 billion in student loan debt has ignited discussions about the role of government intervention in addressing the student loan crisis. The potential impact of this bold plan ranges from immediate relief for borrowers to stimulating economic growth and increasing access to higher education. While the proposal holds promise, its implementation requires a delicate balance between providing relief to those burdened by debt and addressing concerns of fairness, accountability, and long-term fiscal responsibility. As the details of the plan continue to develop, the nation watches closely, eager to see how this significant step toward student loan reform will shape the future of education and economic well-being for millions of Americans.