Although many people don’t use checks for their transactions, they are still widely used in the corporate and commercial worlds. When a business uses checks to make or receive payments, then fraud becomes the next primary concern. As per research, credit frauds are more common than check fraud; however, the latter’s impact is often more significant, no matter if the company is small or large. Now that checks are the main target for fraudsters, a company should employ high-security personal checks to protect its business. This article will guide on a high-security check and its features.

What is a high-security check?

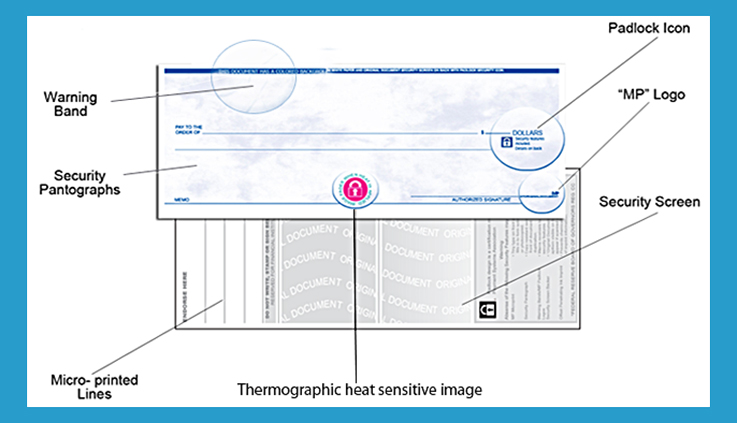

A high-security check boasts a series of features that offers greater security than a conventional check. The features of these high-security personal checks are designed to prevent fraud which makes it much more difficult for fraudsters to target a business.

Opportunists are aware that many small and medium-sized enterprises transact through checks daily and they are easier to tamper with. If a business uses a standard check for receiving and sending payment, not much can be done to put up a metaphorical wire and prevent tampering with the check. However, a high-security check has many security features that make it trickier for fraudsters to tamper with them.

High-security Check Features

Below listed are the features that can be used to elevate the security of checks used for both personal and corporate use:

- High-resolution borders and complex color patterns

Successful check fraud depends on the ability of a fraudster to duplicate a legitimate check. The high-security personal checks featuring high-resolution borders and complicated color patterns are much more difficult to copy and replicate. - Anti-copy technology

High-security personal and business checks utilizing anti-copy technology reduce the risk of check replication and fraud. The state-of-the-art anti-copy technology makes it as tricky as possible for opportunists to replicate checks through traditional copying machines and devices. - Foil holograms

Foil holograms are a visible deterrent for thieves who look for the opportunity to duplicate the checks. Holograms feature internal security features making them virtually impossible to copy the high-security checks. - Chemical reactive and thermochromic ink

The following line of defense for preventing check fraud is chemical reactive or thermochromic ink. This ink dissolves when the chemical or heat is applied which increases the security of both personal and business checks. - Watermarks

Almost every business includes watermarks on their documents and contracts. Similarly, companies and individuals should consider using these watermarks on personal and business checks. Watermarks are used to validate the viability of the checks, as they can be seen by holding the check to the light source. High-security checks with authentic watermarks are difficult to reproduce by copiers or scanners. - False-positive testing areas

The high-security personal checks boasting a false-positive patch enable individuals to validate the authenticity of the personal and business checks by waving a black pen featuring a light over the surface of the checks. - UV ink

The next feature that a high-security check can use to prevent fraud is UV ink. Printing using UV ink is much more complicated, and UV light gets smudged if anyone tries to tamper with the check. For instance, the payment amount is doctored if a fraudster tries to replicate the high-security check printed using UV ink. - Chemical wash detection fields

Chemical wash detection fields are another essential feature of high-security checks. It is specifically designed to identify and highlight the attempts at chemical washing making it impossible for the thieves to tamper with the checks by using the chemical washing method.

Check frauds, especially business check frauds are much more common than anyone may think. One of the main issues with business check fraud is that tampered checks are not easier to identify as fraudsters usually use sophisticated technologies to replicate the checks. To prevent such fraud and loss, businesses should consider using high-security checks for sending and receiving payments.

When dealing with high-security checks, the risk of losing money, brand image, and reputation is reduced to a great extent. These checks are packed with features, such as foil holograms, watermarks, anti-copy technology, chemic reactive and thermochromic ink, etc., making it more challenging for criminals to tamper with them.